One of the smartest ways to build long-term wealth is through Systematic Investment Plans (SIPs). SBI Mutual Fund offers a range of top-rated schemes for 2025 that cater to monthly investors who prefer to systematically grow their wealth. A 10-year SIP plan assists you in amassing ample corpus for future needs such as purchasing a house, children’s education, or retirement.

Why Walk with SIP for 10 Years?

An SIP allows you to invest a fixed amount every month which, owing to rupee cost averaging and the power of compounding, works in your favor most of the time. Ten years is an excellent long-term investment window, giving your money the time it needs to endure the short-term volatility of markets and being able to give handsome returns over the longer period.

Best SBI Mutual Funds for SIP in 2025

The best mutual funds to choose from for a 10-year SIP would be:

1. SBI Small Cap Fund

- High-growth potential, more oriented towards small-cap companies.

- The best option for aggressive investors seeking high returns.

2. SBI Contra Fund

- Invests in stocks undervalued by the market, perfect for contrarian style investors.

- Good for high-value investment and long-term wealth creation.

3. SBI Equity Hybrid Fund

- Portfolio mix of equity and debt provided on a balanced scale.

- Good for moderate-risk-takers.

4. SBI Bluechip Fund

- Invests in large-cap companies with stable performance.

- Can be considered less risky than small-cap or mid-cap funds.

5. SBI Magnum Midcap Fund

- Prefer mid-sized companies for growth potential.

- Choose when you feel slightly adventurous in terms of risk.

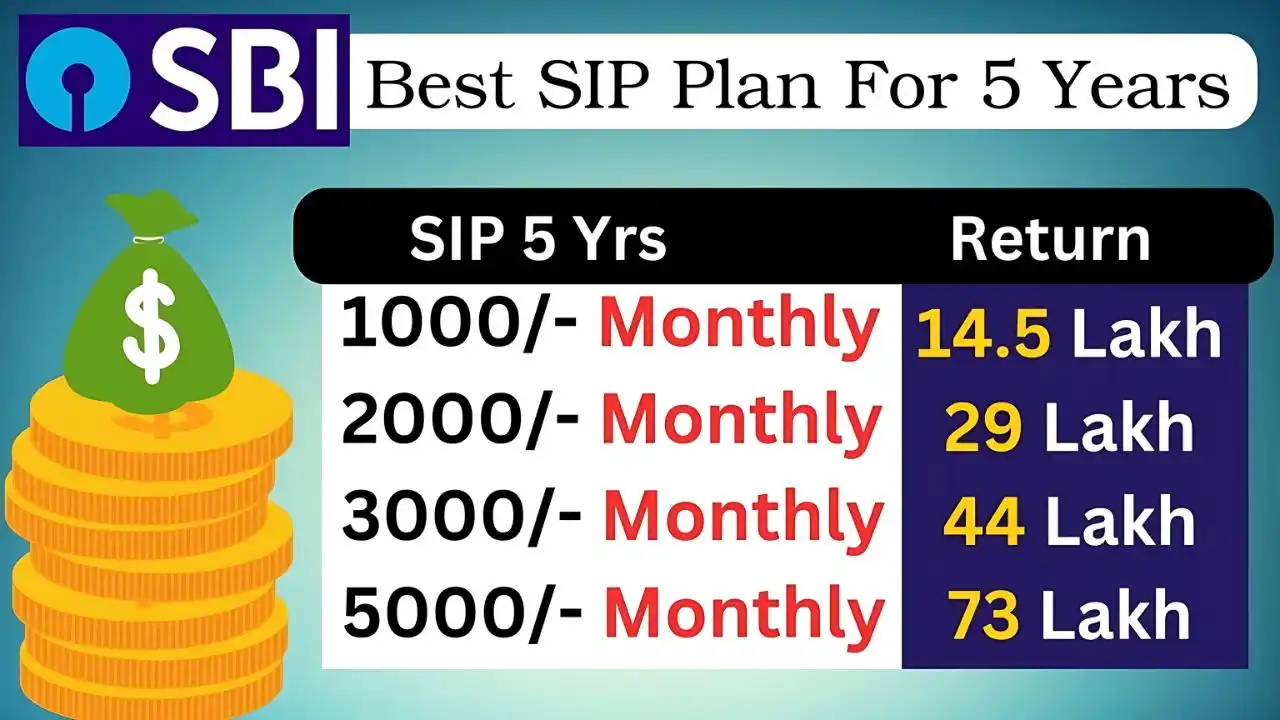

An Example of SIP Returns

Consider depositing ₹10,000 every month in a fund featuring an average 12% annual return:

| Monthly SIP | Tenure | Expected CAGR | Approx. Corpus |

|---|

| ₹10,000 | 10 years | 12% | ₹23.2 Lakh+ |

This is an example showing the ability of compounding and systematic investing.

How to Start SIP with SBI

You can start an SIP online through the SBI Mutual Fund website, via their mobile app, or at the nearest branch of SBI. Select the fund, decide on the monthly investment amount, and select the tenure (10 years), after which you might activate auto-debit as an option of convenience.

Final Thoughts

The best SBI SIP plan of 2025 will depend on one’s risk profile and investment goals. While small-cap and mid-cap funds have the ability to provide a higher rate of return, they do carry the potential of greater risk; bluechip and hybrid funds are terms given to safer and more stable funds. Early start and continuous investment for 10 years give more chance to make wealth!